WEALTH MANAGEMENT

Client signs the asset management mandate

MANAGER

INVESTMENT DECISIONS BY RISK PROFILE

CUSTOMER CHOOSES THE BANK THAT CUSTODIES AND IS EXPONSABLE FOR THE ASSETS

KNOW YOUR COSTUMER

Asset management offered by Valori Asset Management is divided into three broad categories:

- standard management, linked to a single model portfolio for clients with the same profile;

- customized management, designed on specific client needs, always considering the risk profile;

- treasury management, specifically for companies.

Thanks to agreements with leading custodian banks, the Client can open a relationship in his or her own name and is the only person authorized to issue instructions regarding withdrawals and deposits. The Client, a natural person, has the choice of the tax regime to be applied to his investments. The “managed savings” regime allows automatic offsetting of gains and losses regardless of the financial instrument used and is often favored in the choice.

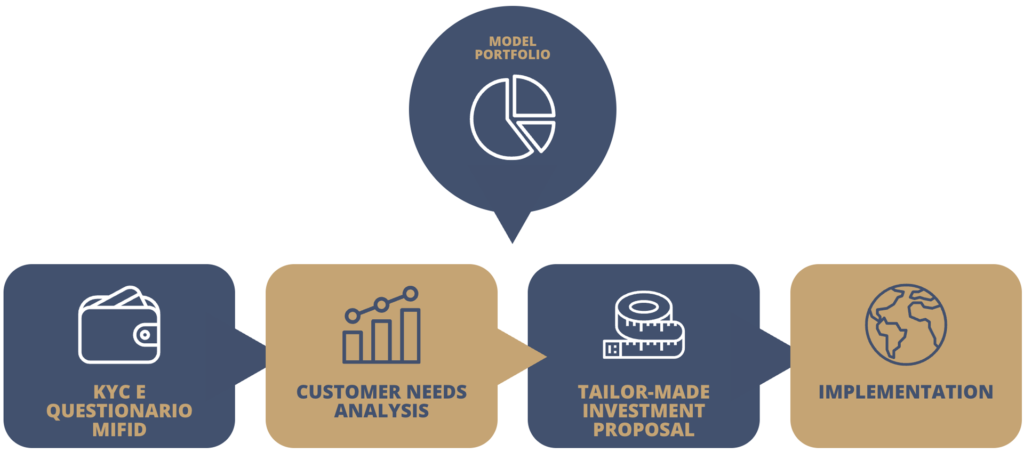

FROM THE MODEL PORTFOLIO TO A TAILOR-MADE PROPOSAL

After identifying with the Client the degree of risk he is willing to take and the time horizon of his investments, our consultants have the possibility to customize the portfolio composition, starting from the model portfolio by comparing with the management team.

Valori AM’s portfolio managers constantly monitor market trends, establish asset allocation choices, and choose the most appropriate instruments in which to invest to achieve the objectives of the management mandate shared with the client

The choice of instruments in which to invest includes individual bonds and equities, ETFs, investment funds, certificates, and structured products in line with the client’s risk profile.

We believe that performance and efficiency on the cost side are linked. Therefore, in addition to systematic planning of invested portfolios, we focus on the level and transparency of the selected instruments to bring a concrete benefit in terms of performance, efficiency, and cost transparency to our clients’ portfolios.

MODEL

PORTFOLIO

KYC e Questionario MIFID

Customer needs analysis

Tailor-made investment proposal

Implementation